Pressemitteilung

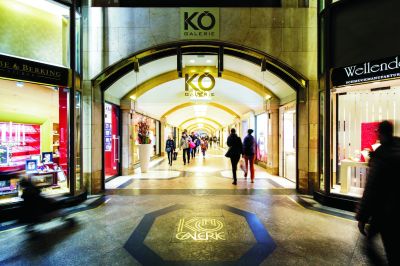

Munich, Germany (September 16, 2024) – PIMCO Prime Real Estate, a leading global real estate investor and manager of the Allianz Group’s $90B+ real estate mandate, is to redevelop its KÖ Galerie mixed-use asset in central Düsseldorf. The firm has appointed German developer Quantum to carry out the refurbishment, which is expected to complete by Q2 2028.

Acquired in 2014, KÖ Galerie has a total gross leasable area (GLA) of 53,000 sqm, with a 17,400 sqm shopping gallery, a 26,800 sqm office component and a Ruby hotel on the upper floors. Situated in the prime Düsseldorf shopping street, Königsallee, the building was originally constructed in 1986 and was last refurbished in 2011. This latest refurbishment includes the restructuring of the vacant office spaces into state-of-the-art workplaces as well as optimizing the ground floor and the access to the retail and office areas. The greening of the terraces will help to improve the user wellbeing and promote biodiversity while the creation of a mobility hub with bicycle parking as its central component is intended to improve access. Moreover, energy-efficient improvements will include thermally insulated roofs, new building façades and new windows.

The redevelopment of KÖ Galerie is the next asset within an ongoing program of select redevelopments in Europe by PIMCO Prime Real Estate as a means to attract and retain prime tenants and create long-term value for investors. Previous projects in Germany include Haus Friesenplatz and Coeur Cologne, both in Cologne, and Haus am Domplatz in Hamburg. Across Europe, completed projects include 7 Avenue George V in Paris, Santa Sofia in Milan and Droogbak in Amsterdam.

Nicole Pötsch Head of North & Central Europe, Co-Head of Investment Europe, PIMCO Prime Real Estate, said: "KÖ Galerie is a very well-located asset and a prime example of a mixed-use building that will benefit from a dedicated asset management program. We have an excellent track record of such refurbishments and remain committed to enhancing value across our European portfolio where necessary."

Frank Gerhard Schmidt , board member of Quantum, said: "We are pleased to be able to upgrade the KÖ Galerie together with PIMCO Prime Real Estate and to contribute our expertise and experience as developer, especially within high-quality redevelopments. Moreover, we are looking forward to further increasing the value of the building through our asset management."

...

About PIMCO Prime Real Estate

A leading global real estate investor and manager, PIMCO Prime Real Estate is a PIMCO company and part of the PIMCO real estate platform, focusing on the Core and Core+ segments of the market and managing the Allianz Group’s $90B real estate mandate.

We manage a global investment portfolio of more than $95B AUM, with an international team of c. 500 employees working in 16 offices in Belgium, China, France, Germany, Italy, Japan, Singapore, Spain, Sweden, the UK and the U.S.

PIMCO’s real estate platform is one of the largest and most diversified in the world, with $187B1 in assets and a broad set of solutions that leverage decades of expertise across public and private equity and debt markets.

...

Footnote: As of June 2024. All figures in USD. 1AUM includes more than $95B in estimated gross assets managed by PIMCO Prime Real Estate, which includes PIMCO Prime Real Estate GmbH, PIMCO Prime Real Estate LLC, and their subsidiaries and affiliates. PIMCO Prime Real Estate LLC is a wholly-owned subsidiary of Pacific Investment Management Company LLC, and PIMCO Prime Real Estate GmbH and its affiliates are wholly-owned by PIMCO Europe GmbH. PIMCO Prime Real Estate LLC investment professionals provide investment management and other services as dual personnel through Pacific Investment Management Company LLC. PIMCO Prime Real Estate GmbH operates separately from PIMCO.

Downloads

About Quantum

Since its founding in 1999, the independent Quantum Immobilien AG has stood for forward-looking project development, attractive institutional investment products and holistic management of real estate investments.

The development business realises its own projects as well as joint venture or service developments. The main focus is on the office, retail and residential asset classes. In addition to new developments, special attention is paid to inner-city redevelopments. To date, real estate projects with a total value of approx. € 6.0 billion have been completed.

In the investment business, Quantum offers customised solutions for institutional investors via its own capital investment company. Assets under management come to a total of approximately € 12.0 billion.